When it comes to running a business, there’s one thing that can make or break your financial success: strategy. It’s not just about making money—it’s about keeping it, protecting it, and making it work harder for you.

Choosing the right business structure, leveraging tax-advantaged accounts, and building effective financial systems aren’t just optional—they’re essential steps to scaling your success. Here’s how to set yourself up for financial stability and growth from the ground up.

Step 1: Choose the Right Business Structure for Tax Savings

Your business structure directly impacts your taxes, liability, and even how you pay yourself. Let’s break down three of the most common options:

1. Sole Proprietorship

As a sole proprietor, your business income is reported directly on your personal tax return, and you’re responsible for self-employment taxes (which include Social Security and Medicare). While this structure is simple, it offers no liability protection and limited tax-saving opportunities.

2. LLC (Limited Liability Company)

An LLC separates your personal and business finances, giving you liability protection while still offering flexibility in taxation.

- By default, LLC income is taxed similarly to a sole proprietorship.

- However, you can elect to be taxed as an S Corporation, which allows you to pay yourself a reasonable salary and take the remaining profits as distributions—saving significantly on self-employment taxes.

3. S Corporation (S-Corp)

An S-Corp is not a separate legal entity but a tax designation you can apply to an LLC or corporation.

- With an S-Corp, you split your income between a salary (subject to payroll taxes) and distributions (not subject to payroll taxes).

- This structure often results in lower overall tax liability compared to a sole proprietorship or default LLC.

Example:

Let’s say your business earns $100,000 in profit.

- As a sole proprietor, you’d pay self-employment taxes (15.3%) on the full $100,000, plus income taxes.

- As an S-Corp, you could pay yourself a $50,000 salary (subject to payroll taxes) and take the remaining $50,000 as distributions, avoiding payroll taxes on the latter portion—saving thousands of dollars.

Step 2: Maximize Tax Savings with Retirement Accounts

Once your business is structured correctly, the next step is to leverage tax-advantaged retirement accounts.

1. Roth IRA

A Roth IRA allows you to contribute up to $6,500 annually (or $7,500 if you’re 50+) with after-tax dollars. The money grows tax-free, and withdrawals in retirement are also tax-free.

- Pro Tip: Even if your income exceeds the limit for direct Roth IRA contributions, you can use a backdoor Roth IRA strategy to contribute indirectly.

2. Solo 401(k)

If you’re self-employed, a Solo 401(k) allows you to contribute both as an employee and employer:

- Up to $22,500 as employee contributions ($30,000 if you’re 50+).

- Additional employer contributions up to 25% of your business income, with a total contribution limit of $66,000 in 2023.

3. SEP IRA

A SEP IRA is another great option for self-employed individuals, allowing you to contribute up to 25% of your net earnings (up to $66,000 in 2023). Contributions are tax-deductible, reducing your taxable income for the year.

Strategy: Use your Roth IRA for tax-free growth and a Solo 401(k) or SEP IRA for tax-deferred contributions to optimize your tax savings and retirement planning.

Step 3: Build the Right Accounting and Financial Systems

Good financial systems don’t just keep your business compliant—they give you clarity, control, and confidence in your numbers.

1. Separate Business and Personal Finances

Open a dedicated business checking account and credit card. This isn’t just about organization—it’s also critical for liability protection and accurate bookkeeping.

2. Use Accounting Software

Invest in accounting software like QuickBooks, Xero, or Wave to:

- Track income and expenses.

- Generate financial reports (profit and loss statements, balance sheets, etc.).

- Simplify tax filing with detailed records.

3. Work with a CPA or Tax Professional

A good CPA is more than a number cruncher—they’re your partner in tax strategy. They can help you:

- Identify deductions and credits you might otherwise miss.

- Plan quarterly tax payments to avoid penalties.

- Analyze your financial reports to make data-driven decisions.

4. Automate Where Possible

Streamline your finances with automation:

- Use expense-tracking apps to categorize transactions automatically.

- Set up recurring bill payments to avoid late fees.

- Schedule payroll to ensure your employees (and yourself) are paid on time.

Step 4: Leverage Tax Deductions and Credits

Maximize your tax savings by taking advantage of deductions and credits designed for business owners:

1. Home Office Deduction

If you work from home, you can deduct a portion of your rent/mortgage, utilities, and internet based on the square footage of your home office.

2. Vehicle Expenses

Deduct business-related vehicle expenses using either the standard mileage rate (65.5 cents per mile in 2023) or actual expenses (gas, maintenance, insurance).

3. Health Insurance Premiums

If you’re self-employed, you can deduct health insurance premiums for yourself, your spouse, and your dependents.

4. Professional Development

Courses, certifications, and conferences related to your business are fully deductible.

5. Start-Up Costs

If you’re just starting your business, you can deduct up to $5,000 in start-up expenses, including legal fees, market research, and business planning.

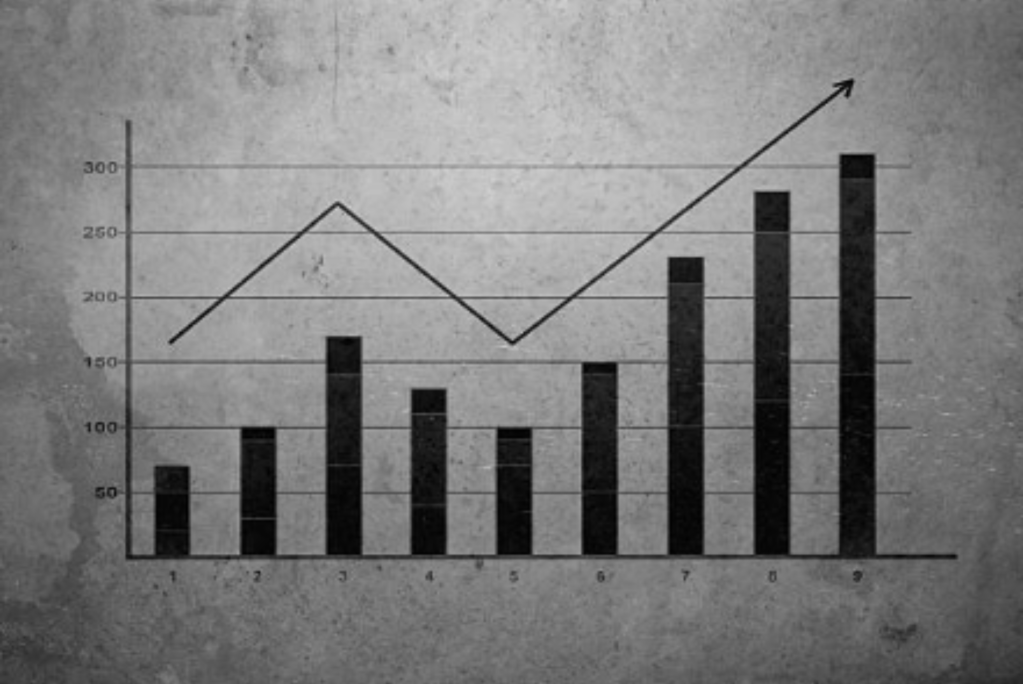

Step 5: Plan for Growth with a Financial Strategy

Once your systems are in place, it’s time to think about long-term growth:

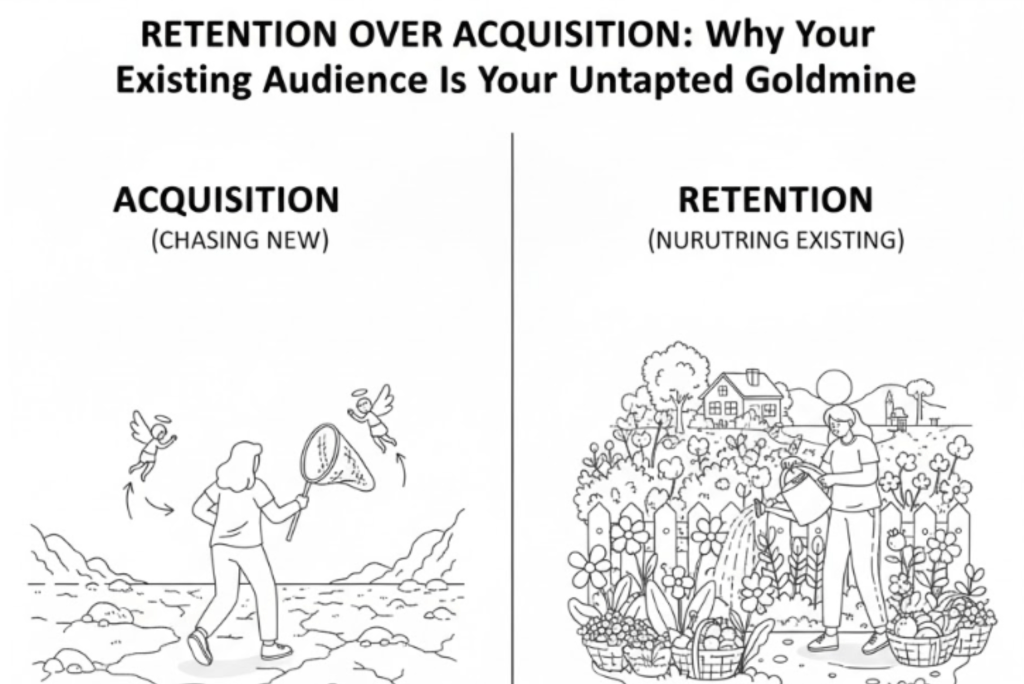

1. Monitor Cash Flow

Cash flow is the lifeblood of your business. Regularly review your cash flow statement to ensure you have enough to cover expenses, invest in growth, and weather unexpected challenges.

2. Set Financial Goals

Create measurable financial goals, such as increasing revenue by 20% or reducing operating costs by 10%. Use your accounting software and reports to track progress.

3. Build an Emergency Fund

Set aside 3-6 months of operating expenses in a separate account to protect your business from unexpected downturns.

4. Reinvest in Your Business

Allocate a portion of your profits to reinvest in areas like marketing, technology, or staff training to drive future growth.

Conclusion: Take Control of Your Financial Future

Building a successful business isn’t just about what you earn—it’s about how you manage and protect your finances. By choosing the right structure, leveraging tax-advantaged accounts, and implementing smart systems, you’re setting yourself up for long-term success.

Remember: your business is only as strong as the foundation you build. Start today, and watch your efforts pay off—not just now, but for years to come.

For more insights and actionable advice, visit LegacyGrowth.Blog and take the next step toward building your legacy.

Leave a comment